We've witnessed quite a bit of run in the stock market since the announcement of QE2 by the Fed.

However, technical indicators have begun to suggest that the market is somewhat overstretched itself and that it may be a good time to take profits. We see divergences in RSI and stochastics and stochastics has begun to turn around (I'm talking specifically about the S&P 500 index $SPX).

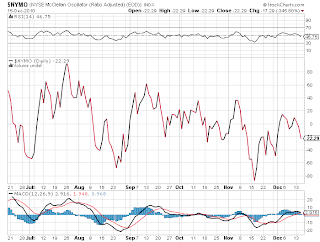

Also, as the charts below show, we see that the breadth of the market (that is the number of issues participating in the run) is becoming weaker as indicated by the McClellan Oscillator. However, from a seasonality perspective, equity markets tend to show good performance between the 2nd and 4th year term of U.S. presidency. Also, we have 'Helicopter Ben' behind the equity market always stand ready to inject more liquidity as needed. But well th history has shown us that money printing never works though and I wonder how it will end this time..

댓글 없음:

댓글 쓰기